us exit tax calculation

Watch our Exit Tax video Part 2 to understand how to calculate the Exit Tax forms to file and some considerations after youve gone through the Exit Tax. If you are a covered expatriate the first 699000 million of gain combined.

/cloudfront-us-east-1.images.arcpublishing.com/gray/UBUCHB5C7RBCRNQF4J553ZUXUE.png)

Virginia Individual Income Tax Filing Season Is Underway

Exit taxes are relevant because some taxable income such as capital gains on home ownership is not.

. Citizenship or in the case of a long-term resident of the United States the date on which the individual ceases. The exit tax calculation. Citizens who have renounced their.

The second way to become a covered expatriate is to have a high-enough average net income tax liability for the five tax years before the year of. The 9 parts are. The United States is unique however in tying its exit tax to a change in visa or citizenship status.

The expatriation date is the date an individual relinquishes US. Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. This is called citizenship-based taxation.

US Exit Taxes. Part 1 April 1 2015 Facts are stubborn things The results of the Exit Tax Part 2 April 2 2015 How. If you are not a covered expatriate it does not matter.

The US exit tax applies to several different types of assets that may be owned by an expatriate and is calculated differently for each type. Other countries have exit taxes too. You should calculate the Exit Tax.

The Price of Renouncing Your Citizenship. In order to calculate the amount of exit. This is Part 4 of a 9 part series on the Exit Tax.

Assets that havent been taxed yet such as capital gains on homeownership or funds in. Exit taxes can be imposed on individuals who relocate. The US Exit Tax calculation is not.

In fact it does not even require that the green. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Instead exit tax is an attempt by the US government to consolidate your US tax affairs.

Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US. If a Green Card Holder has been a permanent resident for at least 8 of the past 15 years they become subject to expatriation tax laws as well.

2021 State Business Tax Climate Index Tax Foundation

What Americans Should Know About The Exit Tax Offshore Living Letter

Tax Calculator Vanguard Charitable

Us Exit Taxes The Price Of Renouncing Your Citizenship

2022 State Business Tax Climate Index Tax Foundation

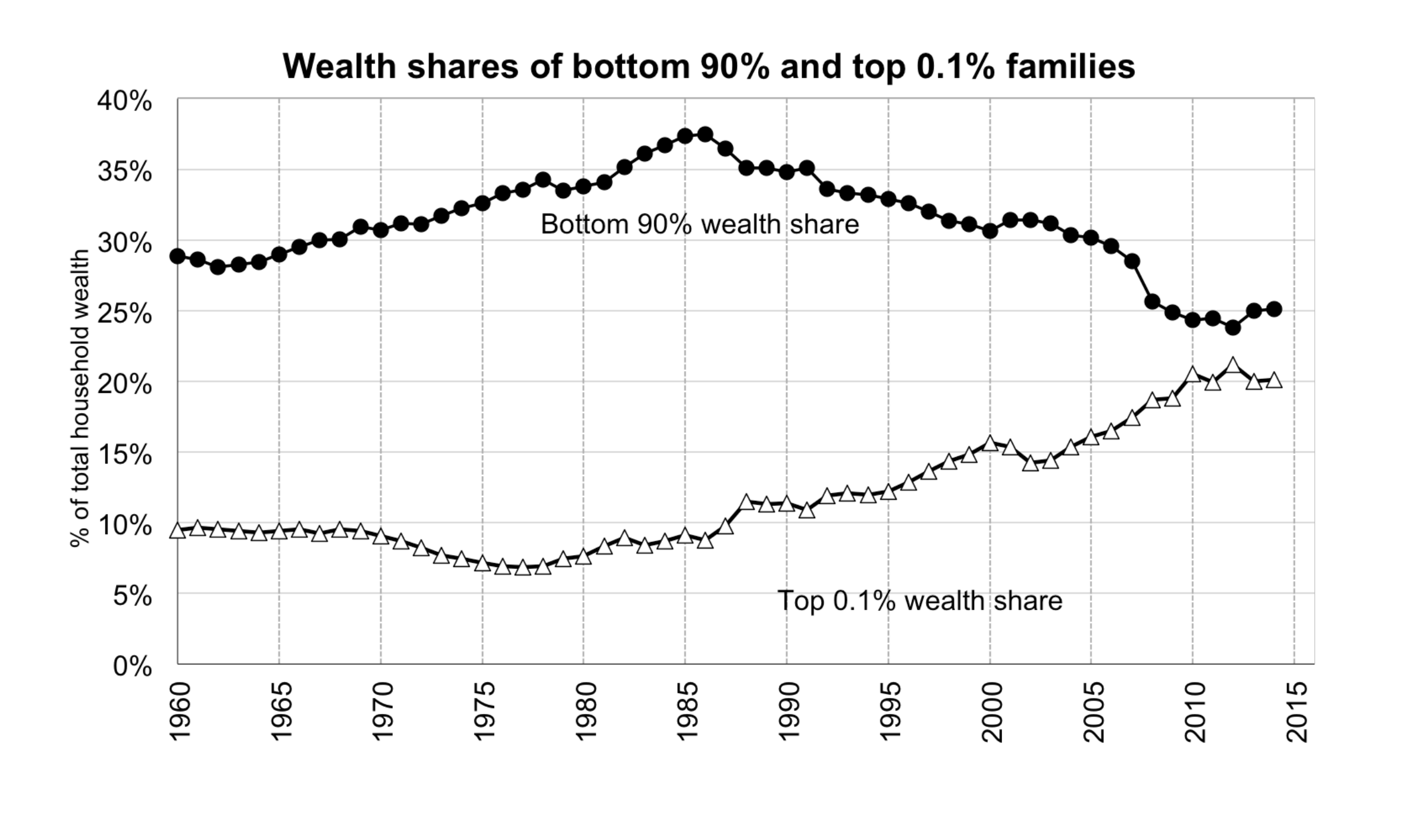

Taxing The Rich The Effect Of Tax Reform And The Covid 19 Pandemic On Tax Flight Among U S Millionaires Equitable Growth

How The Us Exit Tax Is Calculated For Covered Expatriates

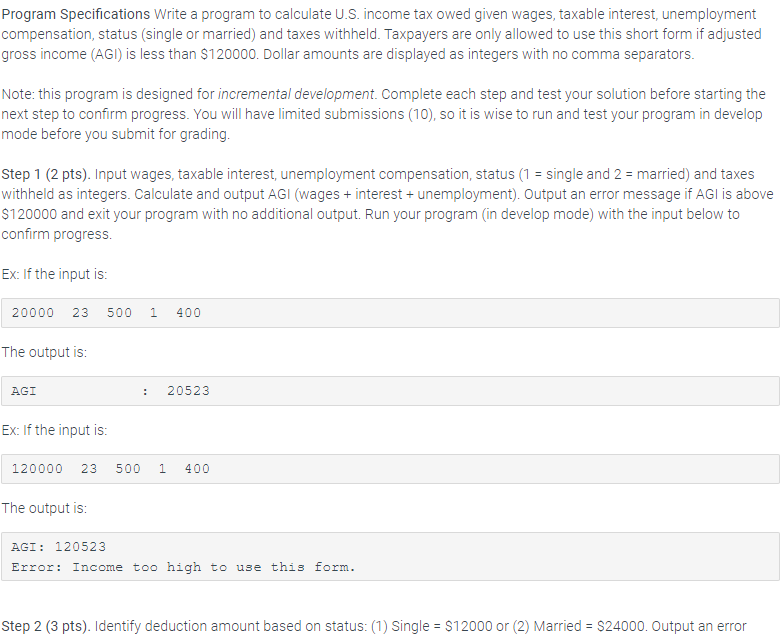

Solved Program Specifications Write A Program To Calculate Chegg Com

Us Exit Tax Calculations At Expatriation Important Tips Youtube

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Income Taxes In The United States Are Imposed By The Chegg Com

Exit Tax In The Us Everything You Need To Know If You Re Moving

Once You Renounce Your Us Citizenship You Can Never Go Back

Leading Edge Alliance International Tax Teleconference Director Patty Brickett International Assignment Services July Ppt Download

Navigating The Tax Implications Of The Covid 19 Pandemic Fisher College Of Business

.png)