capital gains tax news 2020

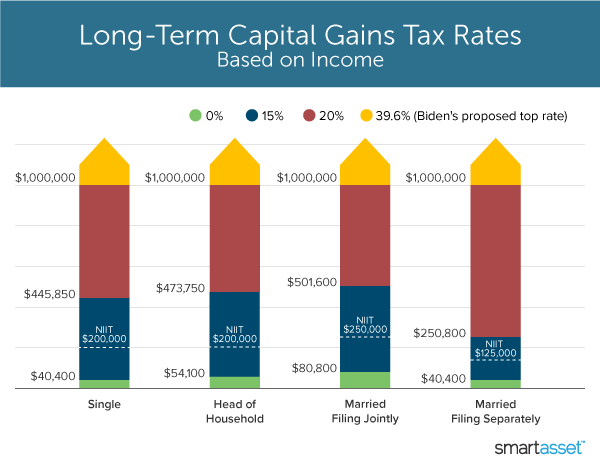

In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. Democrat lawmakers and Governor Jay Inslee for years have sought to enact a variety of tax and regulatory proposals that have failed due to bipartisan opposition from key legislators in both chambers.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gain Tax Rates.

. For single folks you can benefit from the zero percent capital gains rate if you have an income below 40000 in 2020. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay capital gains tax at 10. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022.

Capital Gains Tax May Apply to Gifts Accruing Value The gift tax can apply to both cash and noncash gifts. The tax rate on most net capital gain is no higher than 15 for most individuals. Look this is Washington State just wait until this ends up in the corrupt state Supreme Court.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower. I want to gift property to my children during their lifetime but do not want to use a trust. In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

Capital gains tax rates on most assets held for less than a year correspond to. For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20.

0 15 or 20. This 15 rate applies to individuals and couples who earn at least. The holding period begins ticking from the day after you acquire the asset up to and.

This tax rate is based on your income and filing status. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. 12 Comments on Judge rules capital gains income tax is unconstitutional.

The Lowdown on Capital Gains Tax Rates for 2020 and Beyond Rates for long-term capital gains are based on set income thresholds that are adjusted annually for inflation. 250000 of capital gains on real estate if. Capital Gains Tax CGT implications from April 2020 02022020 - 5 minutes read.

3 election concluded with four incumbents. Stock Market News. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020.

They call me tator salad March 4 2022 at 430 pm. Thats why some very rich Americans dont pay as much in taxes as you might expect. Long-term capital gains are usually subject to one of three tax rates.

It was the worst quarter for stocks since Q1 2020. 3 capital gains tax tables 2022 the profit generated from the sale of a stock is usually taxed at the capital gains tax rate. The short-term capital gain on listed equities held for less than a year is taxed at 15 per cent in the case of listed shares and the applicable tax slab if it is unlisted.

As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. It depends on your tax filing status and your home sale price but you may be eligible for an exclusion. The capital gains tax rate for tax year 2020 ranges from 0 to 28.

Other items to note about short-term capital gains. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The IRS typically allows you to exclude up to.

If I sell you my brand new car for a. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. For most people the capital gains tax does not exceed 15.

What are the main Capital Gains Tax CGT implications from April 2020. Uncle Al March 4 2022 at 424 pm. A gift is a disposal for Capital Gains Tax CGT purposes.

Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent. As the tables below for the 2019 and 2020 tax years show your overall taxable income determines which of.

The capital gains tax regime prescribes the holding period for determining whether the gain made when selling the asset is short-term or long-term. Special real estate exemptions for capital gains. Repeal the 16th Amendmentand the 17th while were at it.

The taxable income thresholds for the capital gains tax rates are adjusted each year for inflation. Capital gains tax LCFS within reach next session. Most single people will fall into the 15 capital gains rate which applies.

The capital gains tax on most net gains is no more than 15 percent for most people. Its also worth noting that.

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Or Capital Losses Are The Gains Or Losses That A Company Or An Individual Experiences On The Sale Of A C Capital Assets Capital Gain Share Market

Australian Taxation Office App

Exemption From Capital Gain Tax Complete Guide

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Tweets With Replies By Sujit Talukder Incometaxdiary Twitter Finance Twitter How To Apply

1k Daily Profit Website The Official Site 2020 Capital Gains Tax Investing Capital Gain

The Long And Short Of Capitals Gains Tax

What S In Biden S Capital Gains Tax Plan Smartasset

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It Capital Gains Tax Capital Gain Rental Property Investment

Capital Gains Tax What Is It When Do You Pay It

You Ll Learn More About The Implications Of Capital Gains And The Mechanics Of Tax Optimization For These Gains With T Capital Gain Case Study What Is Capital

Flows Of Stablecoins Dramatically Slow Down On All Exchanges Cryptocurrency Altcoinnews Btcusdt Flowslowsdown Cryptocurrency Bitcoin Bull Run

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Societe Generale Launches The Fcp Sogeliquid Distribution Mutual Fund Investasi Cocok Pinjaman

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Do I Have To Pay Capital Gains Tax When I Gift A Property The Telegraph In 2022 Capital Gains Tax Capital Gain Setting Up A Trust

What To Do If Your Tax Preparer Can T File Your Taxes By April 15 Tax Preparation Filing Taxes Tax Forms